Irs Schedule Se 2024 Form – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. .

Irs Schedule Se 2024 Form

Source : www.abc27.com1040 (2023) | Internal Revenue Service

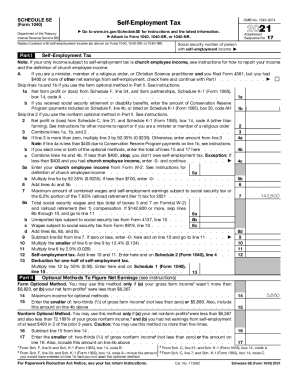

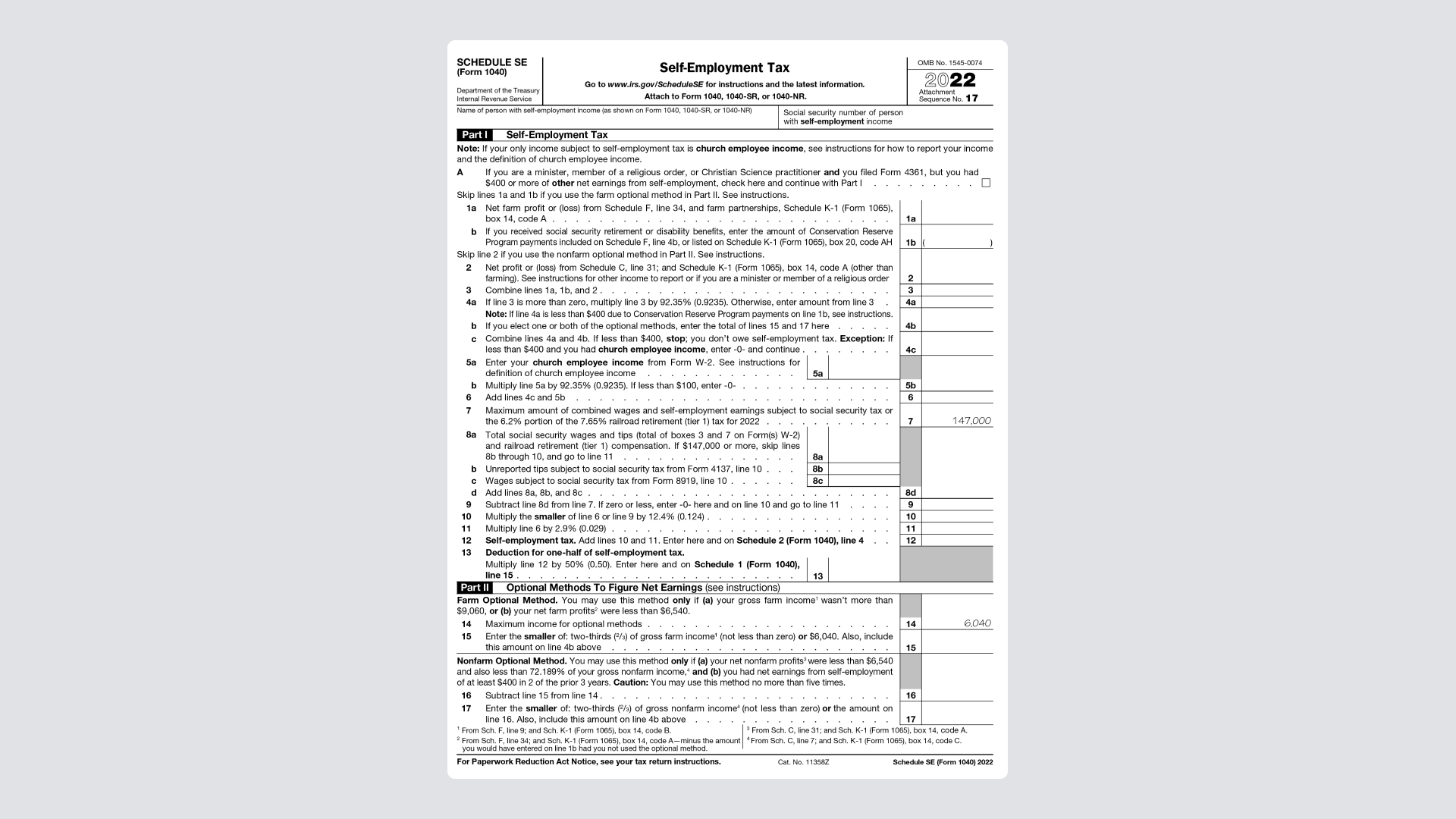

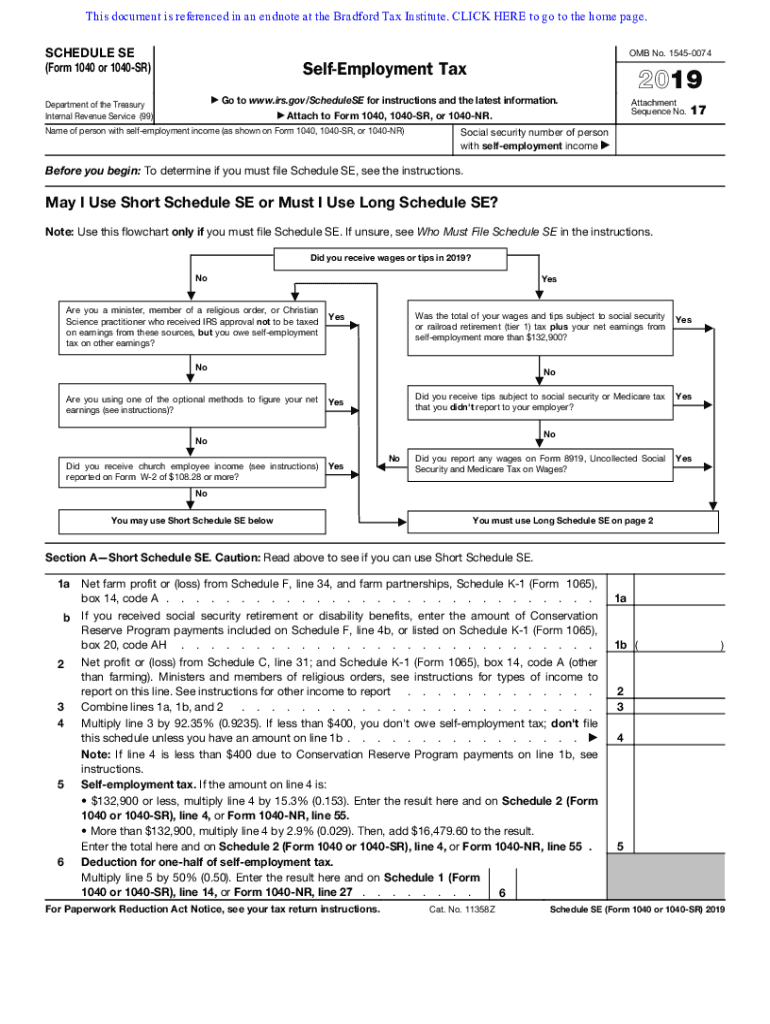

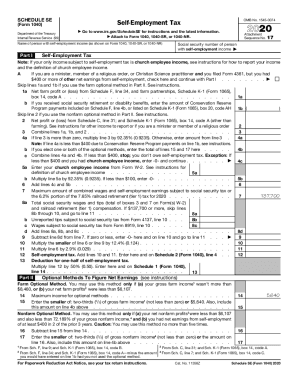

Source : www.irs.gov2023 Form IRS Instruction 1040 Schedule SE Fill Online

Source : tax-form-1040-instructions.pdffiller.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

Source : www.irs.govIRS Schedule SE (1040 form) | pdfFiller

Source : www.pdffiller.comA Step by Step Guide to the Schedule SE Tax Form

Source : found.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule se: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Schedule SE (1040 form) | pdfFiller

Source : www.pdffiller.comIrs Schedule Se 2024 Form IRS Releases Updated Schedule SE Tax Form and Instructions for : Here are our top picks for the best tax apps to help you file your tax return in 2024. Our star ratings Users have access to Schedule SE for self-employment taxes and Schedule C to report . The Internal Revenue Service (IRS) has issued a reminder to farmers and fishers who chose not to make estimated tax payments by January that they must generally file their 2023 federal income tax .

]]>